Launching Obol’s Economic Engine and the Ethereum Staking End Game

Obol announces the launch of the Obol Economic Engine. We’re evolving Obol’s economic layer to support the long-term health of the ecosystem and drive the Ethereum Staking End Game.

As we continue to spearhead the Ethereum Staking End Game, Distributed Validators are emerging as the preferred staking architecture. The Obol Economic Engine aligns the protocol’s economic layer with this trajectory with a focus on scaling the protocol responsibly alongside Ethereum.

Introducing the Obol Economic Engine

As part of Obol’s mission to support the Ethereum Staking End Game, we’re introducing a significant evolution to the protocol’s economic foundation: the Obol Economic Engine.

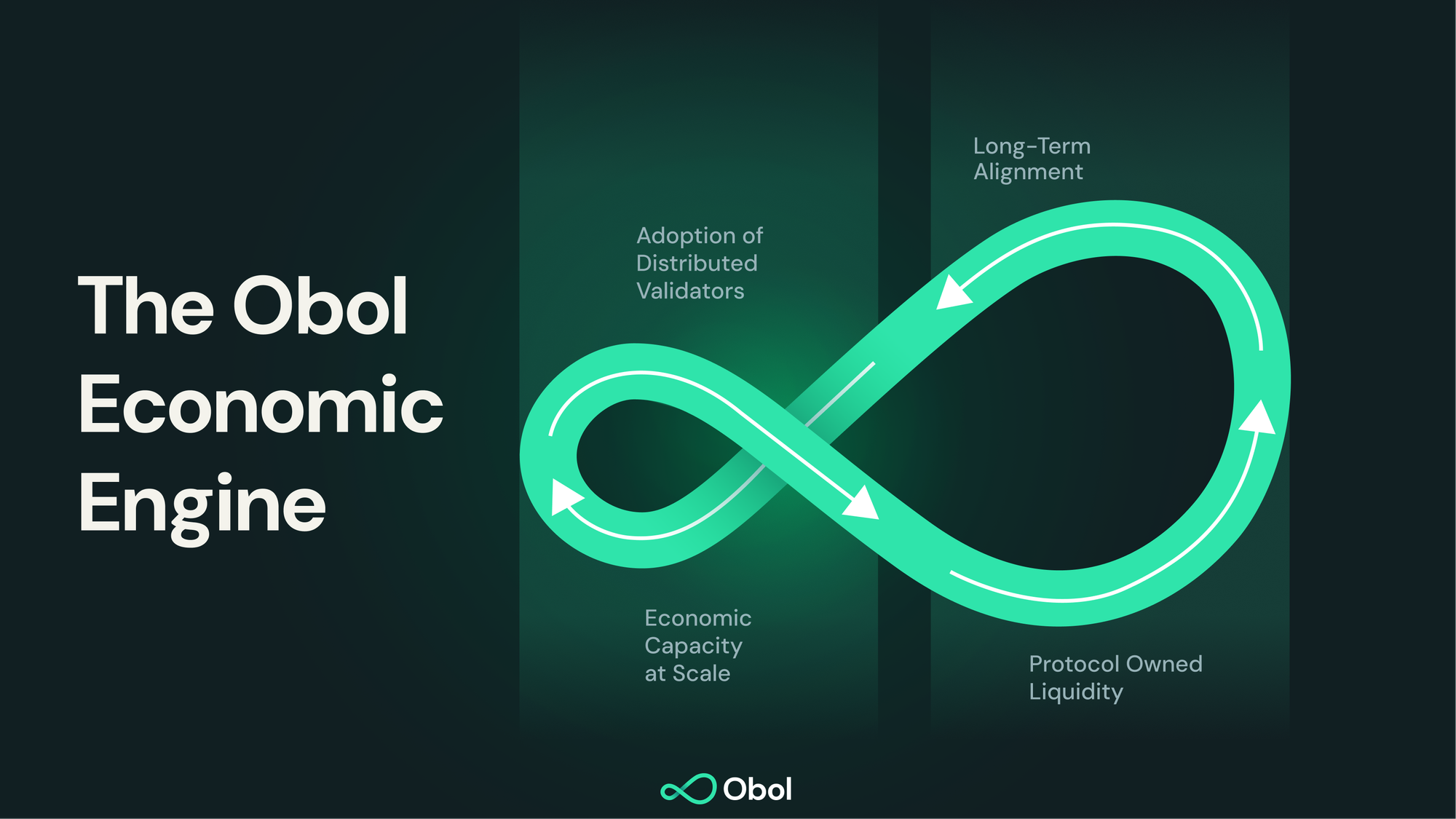

The Obol Economic Engine is a self-reinforcing system designed to align the growing adoption of Distributed Validators with sustainable protocol economics to support the ecosystem’s health.

Obol is scaling and this is the time to launch the Obol Economic Engine. Ethereum is increasingly moving toward an end state in which Distributed Validators replace legacy validator setups. Based on the current trajectory, Distributed Validators could secure a significant portion of staked ETH in the future, positioning Obol as critical Ethereum infrastructure. Ethereum is the foundation of the global onchain economy and Distributed Validators help underpin its resilience, performance, and decentralization.

As the staking ecosystem evolves, Obol’s economics must evolve with it.

Obol Executes Strategic Treasury Operation

In January 2026, Obol executed a Strategic Treasury Operation as part of its commitment to building a sustainable economic foundation for the protocol.

This operation involved allocating a portion of the ETH generated from Obol Distributed Validator Fees to acquire 1,706,309 OBOL. This inventory was then deposited into an LP position in Obol’s Arrakis-managed vaults on Uniswap.

This operation reflects Obol’s committment to focus on Protocol Owned Liquidity, a strategy that aims to increase onchain liquidity depths and improve market health while reducing dependence on external parties. By deploying OBOL as Protocol Owned Liquidity, Obol aims to strengthen our economic sovereignty and support healthier market conditions for the long term.

Distributed Validators and the Ethereum Staking End Game

Obol Distributed Validators (DVs) deliver the Ethereum network’s most resilient and performant staking architecture.

DVs allow Ethereum validators to run across multiple operators and machines, providing Threshold Signing, Distributed Key Generation, Active-Active Redundancy, and no single point of failure. They offer more security and equal or superior performance than legacy validator technology. This is why they represent the Ethereum Staking End Game.

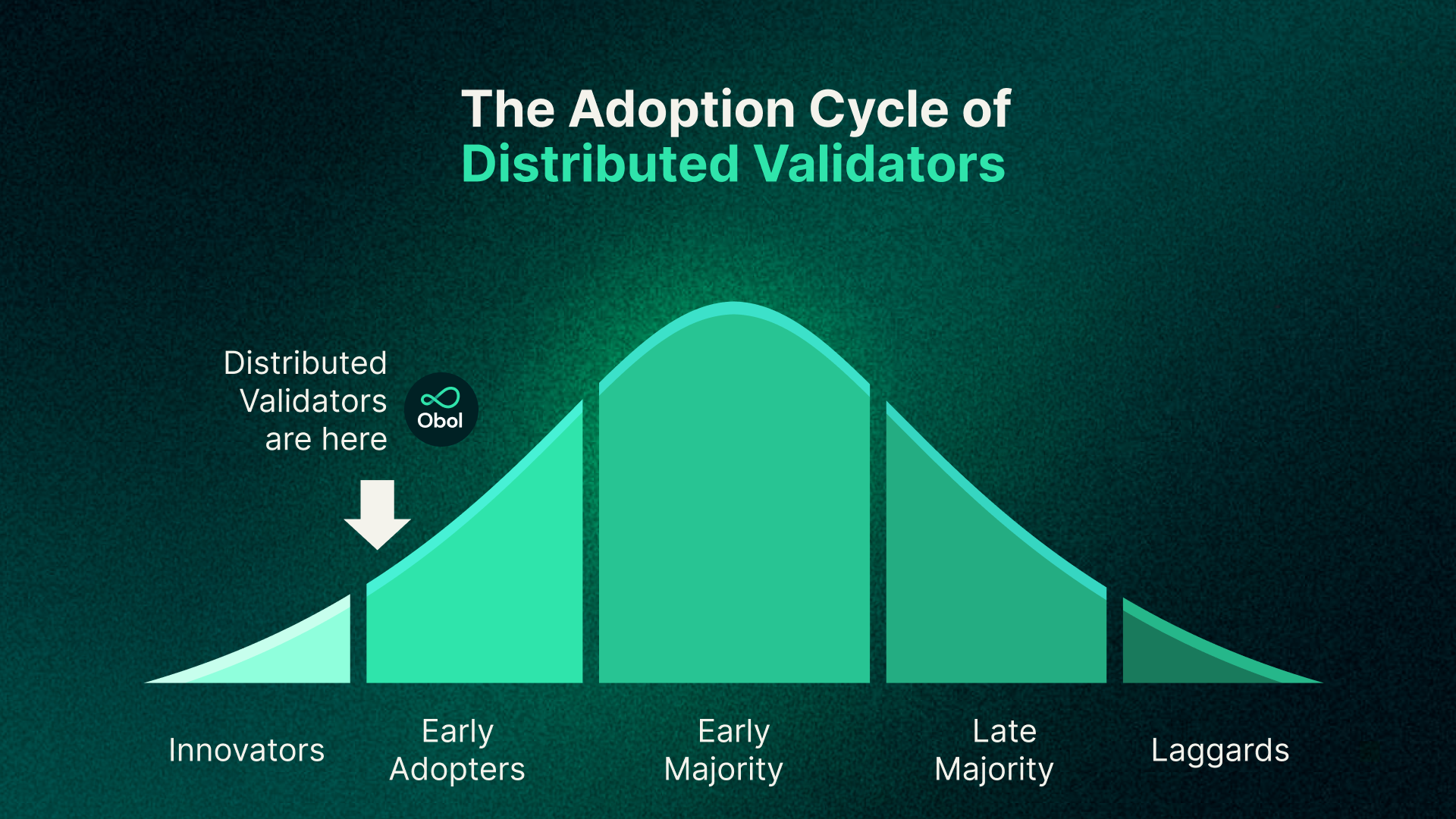

The staking ecosystem is entering a new phase of Distributed Validator adoption. DVs have already been embraced by many of the most notable entities in Ethereum and the staking ecosystem. Liquid Staking Protocols were the earliest adopters and institutional staking providers, custodians, and financial institutions are increasingly evaluating how DVs can harden their operations. We expect ETH-backed ETF issuers, treasuries, and enterprises to turn their attention to DVs next. This essay on The Adoption Cycle of Distributed Validators further outlines our view on the future of Distributed Validator adoption.

This trajectory is further supported by the results from the 2025 Ethereum Institutional Staking Survey conducted by Obol, Lido, and Kaiko. This survey gathered responses from more than 70 leading custodians, node operators, fund managers, and ETF issuers. Their responses highlighted the institutional staking market’s growing interest in fault-tolerant, multi-operator validation with DVs.

Obol and Ethereum’s Next Era

As more major entities upgrade to DVs, the total value secured by Obol is expected to increase. Under one illustrative scenario — assuming continued Distributed Validator adoption, Ethereum growing to a multi-trillion-dollar market capitalization, and Obol growing its market share — Obol could secure a significant portion of staked ETH over the next decade. Depending on the fee levels, Obol’s growth could translate into meaningful protocol revenue. This excludes any additional revenue from the Obol Stack or future product lines.

Ethereum is evolving and institutions demand a robust staking environment. The Obol Economic Engine is designed to ensure Obol’s economics support the protocol’s long-term health as it continues to drive the Ethereum Staking End Game.

The Four Pillars of the Obol Economic Engine

The Obol Economic Engine rests on four core pillars that collectively support sustainable protocol growth:

Pillar 1: Distributed Validator Adoption. As adoption increases, Obol’s role in the staking ecosystem grows, and Ethereum’s security and decentralization improves.

Pillar 2: Economic Capacity at Scale. As more ETH is secured by Distributed Validators, Obol’s fee-generating capacity expands, supporting the ecosystem’s long-term sustainability.

Pillar 3: Protocol Owned Liquidity and Improved Market Structure. Protocol Owned Liquidity enhances onchain depths and improves execution, while reducing dependence on external actors. In turn, this improves market health.

Pillar 4: Long-Term Alignment and Stewardship. The OBOL token functions as the ecosystem’s coordination and alignment mechanism within the Obol Economic Engine.

Obol’s Strategic Treasury Operation, conducted in January 2026, effectively marked the Obol Economic Engine’s launch. Obol executed this operation as part of its stated focus on Protocol Owned Liquidity. Building Protocol Owned Liquidity and deploying OBOL onchain enhances liquidity depth and improves market health, while building protocol sovereignty with Obol-owned liquidity. The aim is to build a strong economic foundation for Obol.

Advancing the Infinite Ethereum Economy

Ethereum is building toward a multi-trillion dollar economy supported by robust staking infrastructure. Many leading teams across the space share our view that the Ethereum ecosystem is set to continue growing.

With the launch of the Obol Economic Engine, Obol is entering a new development phase focused on supporting Ethereum’s long-term trajectory through sustainable economics. Our goal is to build a strong foundation that will ensure we can continue to advance the infinite Ethereum economy.

Disclaimer

This post is provided for informational purposes only and does not constitute financial, investment, legal, or tax advice. It contains forward-looking statements and illustrative scenarios regarding potential protocol economics, adoption trends, and future developments. Such statements are based on current expectations and reasonable assumptions but involve known and unknown risks and uncertainties that may cause actual outcomes to differ materially. Any figures quoted in potential future scenarios are illustrative only and are not forecasts, commitments, or guarantees. Actual outcomes will depend on technical, economic, and market factors. Nothing in this post constitutes an offer or solicitation to purchase or sell any token or financial instrument, nor does it imply any expectation of value, profitability, or return. All protocol parameters, economic mechanisms, and treasury decisions are subject to change in the future. Obol undertakes no obligation to update forward-looking statements.