Obol x Lido V3 Is Here: Unlock the Highest Minting Capacity With Distributed Validators

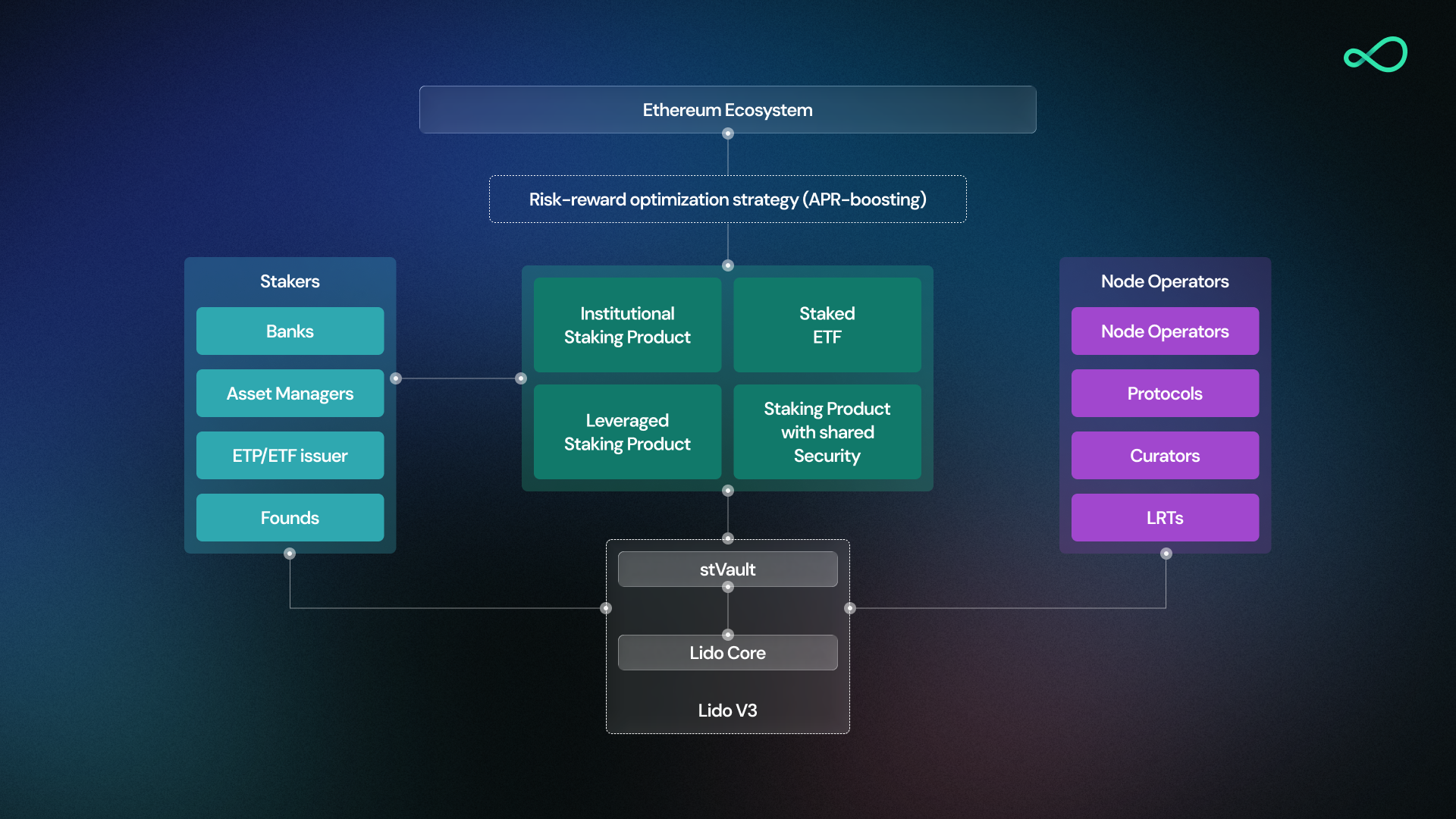

Lido V3 is rolling out customizable vaults, offering node operators much greater flexibility. Obol DVs offer the most capital-efficient way to manage stake on the offering.

Lido V3’s stVaults promise to transform the staking landscape. Utilizing Obol Distributed Validators with stVaults unlocks the highest minting capacity and enables operators to deploy the end game staking configuration.

Lido has been one of the Ethereum staking ecosystem’s pillars since inception. The liquid staking pioneer changed Ethereum when the Beacon Chain launched and its V3 upgrade is set to transform the space once again. Lido V3 introduces stVaults—modular staking vaults that unlock stETH liquidity to institutional stakers and asset managers.

Obol has long been a key infrastructure provider to Lido. The liquid staking protocol selected our Distributed Validator infrastructure to secure their first module, Simple DVT, and has since opted to integrate Obol’s DV infra into their flagship product, the Curated Module.

Both Lido and Obol are united by a common purpose: advancing Ethereum with next-generation staking infrastructure. Obol provides a resilient alternative to legacy validator technology and Lido recognizes that.

Obol is pleased to support Lido V3 as a day one launch partner. With the launch, we’re rolling out the stVault Integration Kit to cater to institutional node operators.

Lido V3 changes the staking landscape, offering depositors improved capital efficiency and liquidity with flexibility to suit their exact needs. Obol Distributed Validators are the best way to deploy an stVault and we explain how below.

Understanding Lido V3

Lido V3 builds on the protocol’s previous release with a focus on modularity. V3’s stVaults are permissionless deployments that let institutional stakers, node operators, asset managers, and protocols oversee their stake with extreme flexibility. stVault owners can adjust parameters like fees, node operator selection, and MEV configuration while unlocking stETH liquidity.

One of Lido V3’s key upgrades is the introduction of a Reserve Ratio (RR), which determines the amount of ETH that must be kept as a reserve buffer relative to minted stETH. Lido is proposing a RR tier of just 2% for verified multi-operator DVT vaults, which would allow up to 98% stETH minting capacity. So if an operator managed 10,000 ETH in stake with 200 ETH in reserve, they would be able to mint 9,800 stETH.

The 2% tier for DVT vaults is the most favorable tier because it offers the highest minting capacity and capital efficiency. By comparison, the next-highest default tier for identified operators proposes a RR of 5% with 95% stETH minting capacity. Obol Distributed Validators are the go-to infrastructure for vault owners optimizing for capital efficiency.

Introducing the stVault Integration Kit

As part of Lido V3’s launch, we are rolling out the stVault Integration Kit, a guided path for node operators and capital allocators to design stVaults and accelerate their deployment on Obol DVs.

The stVault Integration Kit is an easy-to-use tool kit for building V3 stVaults with maximum capital efficiency. It explains how to architect a multi-operator Obol DV cluster, how that feeds into Lido’s Reserve Ratio model, and how to create a mainnet-ready stVault in a structured way. Deploying a V3 stVault with Obol lets operators go from planning to mainnet in just a few weeks.

V3’s core innovation is flexibility: stVaults and reserve ratios can be tuned to match each vault’s risk profile and capital needs. The stVault Integration Kit leans into this by showing how node operators in DV clusters can customize their validator setup and opt into additional duties such as preconfirmations or custom MEV solutions. Multi-operator set-ups align with Lido’s most favorable Reserve Ratio tier and unlock the highest minting capacity available.

For asset allocators, the stVault Integration Kit does two jobs: it explains what a high-quality stVault operator set looks like and how DVT-backed vaults can deliver both strong security and high capital efficiency. It also introduces Obol’s Cluster as a Service, a white glove solution where Obol curates node operators with you, aligns on a staking strategy, and supports deployment, monitoring, and SLAs so your vault is “production-ready” from day one. The stVault Integration Kit is the essential tool kit for deploying a vault on DVs on the new offering.

The stVault Integration Kit is live now—head here to get started.

The Staking End Game

Lido V3 represents a new chapter for the staking ecosystem, where institutions and node operators alike can flexibly manage their stake and access liquidity as required. Obol’s DVs offer these groups the most capital-efficient way to run a vault on Lido V3. For any operators looking to deploy a vault secured by DVs, our stVault Integration Kit is the best way to get started.

The staking ecosystem has rapidly matured over the past few years and customizable vaults represent another leap forward. Like Lido V3’s customizable vaults, Obol DVs will play a big part in the future of staking. More and more ETH will be staked over time and a growing portion of it will live across DVs. As key innovators in this ecosystem, Lido V3 and Obol are both building the infrastructure that will lead us to the staking end game.