Obol Q3 2025 Ecosystem Report: Institutions Embrace Distributed Validators as Ethereum Marks 10th Birthday

Unpacking one of the most eventful quarters in Obol’s history, with highlights including an appearance in the Token Transparency Framework, new institutional adoption, key DeFi integrations, and more.

Obol crossed $3 billion in TVS, shipped new product features, and welcomed a host of new ecosystem partners in Q3.

Ethereum’s Institutional Moment and the Staking Landscape

Q3 was bound to be a big quarter. Obol was already accelerating on several fronts as summer kicked off and this quarter also saw Ethereum mark its 10th anniversary in July. Ethereum’s entry into a new decade comes during a consequential moment for adoption and period of renewed unity across the community. As ETH gains acceptance as a store of value in digital asset treasuries, it’s become clear that Ethereum’s institutional era has arrived.

This shift has a meaningful impact on the staking landscape. Many institutions are accumulating ETH because it is a productive asset and they plan to stake to accrue yield. As a result, many major entities have discovered how Obol Distributed Validators improve Ethereum for the first time this quarter.

Major staking operators and liquid staking protocols alike integrated Distributed Validators this quarter and we’ve also welcomed a cohort of new Silver Techne holders, proving that Obol serves both professional operators and home operators. Obol Distributed Validators still consistently outperform legacy validators in performance, as shown by our RAVER scores.

Other big achievements of the past few months include our appearance in Blockworks’ state-of-the-art Token Transparency Framework, crossing $3 billion in Total Value Staked (TVS), and Stakely, Pier Two and Blockdaemon’s adoption of Distributed Validators as part of Lido’s Curated Module.

Their upgrades came after Lido expanded support for Obol in its Curated Module, which is the largest pool of staked ETH representing ~25% of the protocol’s TVL. This is one of the clearest signs yet that our technology will power the staking end game. Plus, with the newly updated Curated Module, Lido has become a home for multi-operational clusters, ensuring the protocol attracts the best quality stake in the entire ecosystem.

These updates land during a period of strength for the whole staking ecosystem. Lido itself has had a busy few weeks as it enters the home straight to unveiling its V3 upgrade. Obol will be the de facto choice for Lido V3 vault users because it will offer reduced risk and more rewards.

This is an exciting time for Obol, the staking ecosystem, and Ethereum as a whole. Ethereum solidified its position as the institutional platform of choice in Q3. It’s become the natural destination for capital allocators looking to stake. Major operators are also becoming more and more interested in upgrading from their legacy validator technology to Distributed Validators and both our research and continued adoption this quarter proves it.

In short, Ethereum is maturing and Distributed Validators are a foundational part of the future. We offer a full breakdown below.

1. Obol’s Q3 in Numbers | OBOL Joins Token Transparency Framework, $3B+ in TVS and More

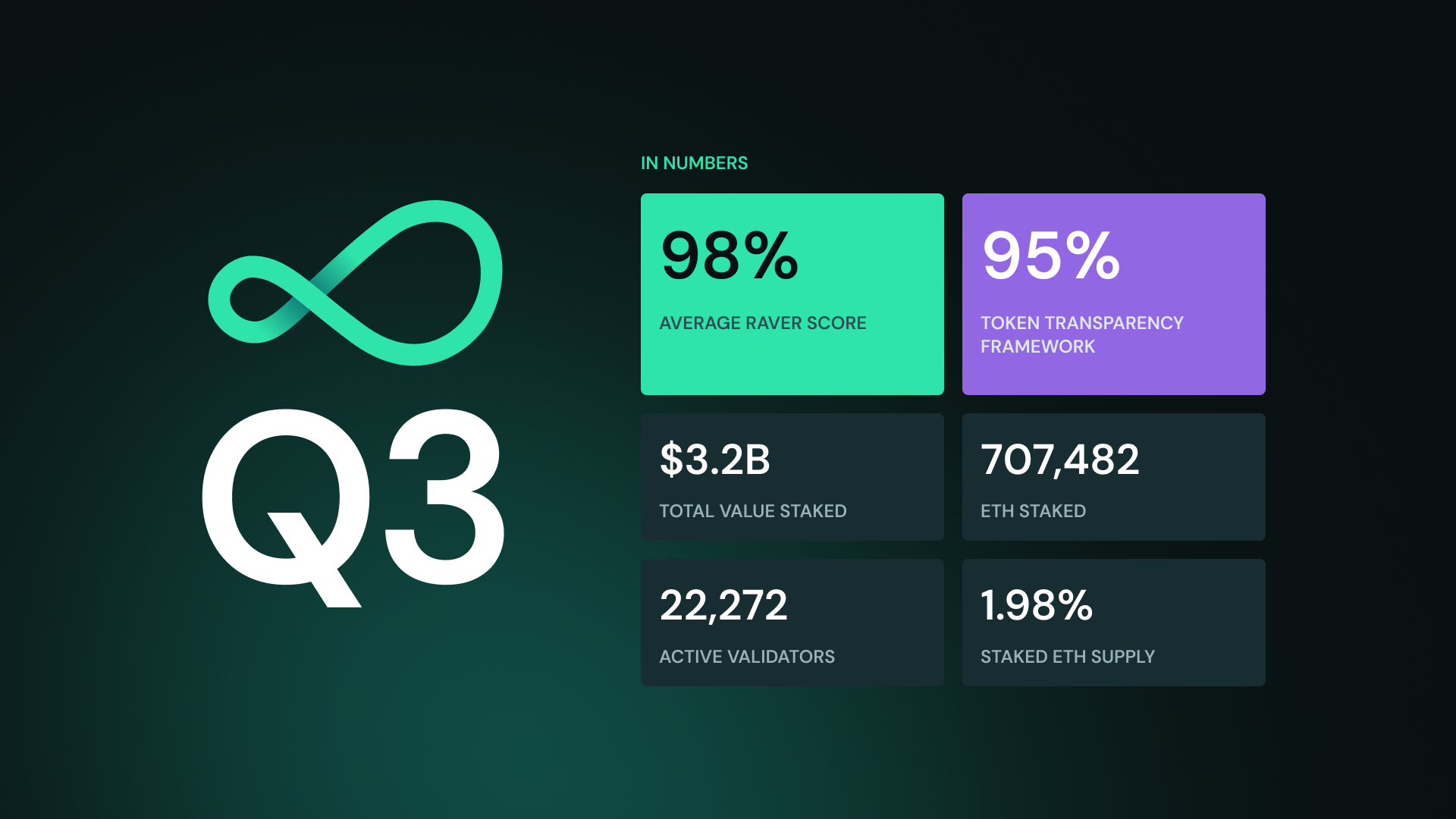

Obol crossed $3.2 billion in value staked this quarter, up from ~$1.4 billion at the end of Q2. That’s a 128% increase.

Our Distributed Validator infrastructure has also improved in performance terms, consistently ranking ahead of legacy validator technology with an average RAVER score of over 98%. The amount staked on Obol Distributed Validators passed 700,000 ETH for the first time, which represents 1.98% of the total supply of staked ETH.

Additionally, the OBOL token achieved a near-perfect number rating this quarter through Blockworks’ Token Transparency Framework. OBOL received a 95% (38/40) score, which is a sign of its position as a professional-grade, investable asset with a sustainable future. OBOL prioritizes transparency where many other projects fall short and we believe this approach will win in the long run.

Resources:

Obol hits $3.2B in TVS [@Obol_Collective]

Obol September 2025 Snapshot [@Obol_Collective]

OBOL Achieves Near-Perfect 95% Rating in Token Transparency Framework [Obol Blog]

2. New Obol Adoption | Lido and Liquid Collective Show Conviction in Distributed Validators

Obol forged key partnerships with several leading teams over the summer, showing that the market’s conviction in Distributed Validators is growing. Major operators are not just compelled by the promise of Distributed Validators. They’re also lining up to deploy stake on them in preparation for Ethereum’s future.

Perhaps most notably, Lido expanded support for Distributed Validators in the Curated Module, the largest staked ETH pool that makes up ~25% of all staked ETH. Lido had previously supported Distributed Validators in its smaller modules (Simple DVT and CSM) and this move is a sign that it’s ready to double down on Obol’s technology. Stakely, Pier Two, and Blockdaemon are the first teams to upgrade their infra within the Curated Module with more to follow soon.

The institutional-focused liquid staking protocol Liquid Collective also adopted Distributed Validators for a portion of its active set. Obol first joined forces with Liquid Collective in April 2024 and co-founded the Node Operator Risk Standard (NORS) with them and other leading teams to establish better staking risk management standards.

We also partnered with the memory infrastructure project Optimum to decentralize and scale Ethereum at the same time. We’re exploring how Optimum can help Distributed Validators become even more performant. Meanwhile, the OBOL token also scored several notable DeFi integrations this quarter. Read more in the Community Snapshot section below.

These updates are the product of months of work behind the scenes by the two leading core teams but the final stretch of the year looks to be even busier. We’re currently preparing for the rollout of Lido V3 and its first customizable staking vaults. This is one of many exciting updates coming down the pipeline in Q4 and we’ll share news on V3 and more soon.

Overall, these developments point to a growing appetite among major operators to upgrade their staking setups. Many teams have shared this sentiment with us in recent months so we expect Distributed Validator adoption to accelerate into the tail end of the year and beyond.

Resources:

Liquid Collective’s Active Set Now Includes Distributed Validators [Obol Blog]

Stakely Upgrades to Distributed Validators in Lido Curated Module [Obol Blog]

Pier Two Supporting Distributed Validators in Lido’s Curated Module [Obol Blog]

Blockdaemon Doubles Down on Obol Distributed Validators [Obol Blog]

Obol and Optimum Unite to Supercharge Ethereum Scaling [Obol Blog]

Proposal: Curated Module Intra-Operator DVT Guidelines [Lido Governance Forum]

3. Product Updates | Charon Adds Multi-Client Support, Launchpad Ships Operator Rotation, and More

The last quarter was not just a success in terms of Obol adoption. We also had several notable product rollouts across Charon, CDVN, and the launchpad.

Charon

Charon has also received a number of improvements this summer. The latest version offers chain split protection, performance improvement when fetching attestation data, new Consensus Layer and Validator Client support with Grandine and Vouch, QUIC transport for improved performance, validator additions to existing clusters, custom graffiti for each peer, a 60 million gas limit for the Pump the Gas scaling effort, and more.

CDVN

Our default launcher, CDVN, can now deploy alternative MEV Clients via commit-boost (rather than mev-boost), as well as alternative Consensus Layer and Validator Clients. This means users have the ability to select new clients when launching Charon with CDVN.

Obol DV Launchpad

Our launchpad shipped Operator Rotation, allowing users to consolidate multiple validators into one single validator. Similar to OVM, this update was made possible after Ethereum’s Pectra hardfork enabled validator consolidations.

Obol will also support Lido V3 from launch day. Look out for more news on how dropping soon.

Resources:

Charon ships multi-client support and more [@Obol_Collective]

Charon adds CL and VC support, Pump the Gas, and more [@Obol_Collective]

4. The OBOL Token | DeFi Innovators Integrate stOBOL

The OBOL Token launched in May and has recorded several significant updates since then. This quarter, the OBOL Token was recognized as one of the most transparent tokens on the market in the Token Transparency Framework, while the cutting-edge DeFi project Gearbox added support for OBOL staking rewards with up to 40x leverage via Mellow Vault (dvstETH). Pendle will also soon support Staked OBOL (stOBOL) and we’ll share more news very soon.

Seeing some of the space’s most innovative teams experiment with the OBOL Token shows it has a place at DeFi’s cutting edge. But the OBOL Token has more integrations in the pipeline that will further cement its standing as an enterprise-grade asset.

These recent updates come as confidence in Ethereum and ETH grows stronger propelled by the ongoing institutional adoption wave. As Obol works to advance Ethereum with secure validation, the OBOL Token offers a way to express conviction in its future.

Resources:

OBOL Achieves Near-Perfect 95% Rating in Token Transparency Framework [Obol Blog]

Gearbox offers 40x leverage on OBOL staking rewards [@GearboxProtocol]

5. Community Snapshot | Squad Staking in CSM v2 Is Live

Community staking got even easier in Q3 as Lido updated the CSM module. CSM v2 introduces Identified Community Stakers and other improvements. With squad staking, individuals can get started with as little as 0.3 ETH and enjoy boosted rewards. It’s the easiest path to mainnet.

It was also a busy summer for the Obol Collective. This quarter, we shipped the Delegate Reputation Score, our pioneering rewards model that uses reputation points to reward real contributors.

The Collective also allocated grants to Curia, DAMM, and Vista through the Grants Program Pilot Wave, before launching the Obol Grants Program in earnest. This framework offers three focused tracks for individuals to contribute to Obol and get rewarded based on their skills and interests.

One area where we’ve been quieter than usual on the community front is the events calendar. This is mostly because the industry takes a break from conferences during the summer, but we’ll be ramping things up towards the end of the year. The big date in the calendar is DevConnect Buenos Aires, where the Obol team will be in attendance alongside various side events throughout the week. Find us and say hi if you’re in town.

Resources:

Squad Staking in CSM v2: More Nodes, Less Risk, Higher Yield [Obol Blog]

AMA: Future of Governance and Delegate Reputation Score [@Obol_Collective]

Delegate Reputation Score is live [@Obol_Collective]

Grants Program Pilot Wave Report: Pilot Phase Wrap-Up [Obol Blog]

The Obol Grants Program Is Now Live [Obol Blog]

6. In the News | Institutional Reports Highlight Obol’s Value

Obol dropped two in-depth institutional reports in Q3. The first one covered ETH’s emergence as a productive treasury asset with input from Anthony Sassano, Vivek Raman, and other key Ethereum voices. We also published a report uncovering trends in the staking ecosystem and where we could be headed next, which includes all the key findings from the Ethereum Institutional Staking Survey we conducted in partnership with Lido and Kaiko. We heard from 70+ of the biggest names in Ethereum staking and our results were highly conclusive.

Both pieces offer an insight into why the space’s top names are turning their attention to ETH and Distributed Validators. In short, this is happening because the Ethereum ecosystem is thriving and institutions are beginning to understand the path ahead.

Other reads we’d recommend include The Adoption Cycle of Distributed Validators, which sees Obol’s VP of Ecosystem Anthony Bertolino argue that we are in the “early adopter” phase of Obol’s technology. One of Ethereum’s most vocal proponents, Evan Van Ness, explained how Obol makes Lido more decentralized in a viral thread comparing Bitcoin and Ethereum.

We’ve also been active on air over the last quarter. In Q3, we sat down with the Magma and Aztec teams as well as Doots Live! and thefett to discuss how Obol contributes to Ethereum’s decentralization and more. Lock in to hear our (occasionally spicy) takes on how the staking ecosystem is likely to evolve.

Resources:

Ethereum’s Trillion-Dollar Catalyst: ETH as a Productive Treasury Asset [@Obol_Collective]

Comparing Bitcoin and Ethereum’s decentralization [@evan_van_ness]

The Adoption Cycle of Distributed Validators [@iDecentralized]

Hot Spaces - A Magma Sitdown [@MagmaStaking Spaces]

Aztec Townhall 7 Recap [@Obol_Collective]

#126 Doots Live! - Obol [@EVMavericks]

Decentralizing the validator set w/ Oisin of Obol [thefett]

7. Wrapping Up

In summary, it’s been an eventful quarter and we’ve notched a number of big wins in that time. Ethereum is enjoying a resurgence and the community feels more united than ever, which is good for Obol because Ethereum’s success is our success. But just as importantly, OBOL was recognized as one of the most transparent tokens on the market, Distributed Validator adoption climbed thanks to moves from major entities like Lido and Liquid Collective, and we shipped big updates in Charon.

Next up, we hope to see continued performance improvements and growth in the amount of ETH staked on Obol’s infrastructure. Obol Distributed Validators offer teams the most secure, performant way to stake and Ethereum’s institutional moment further proves their value. 30% of ETH is staked today and we expect that number to rise in the future. Eventually, much of this stake will be secured by Distributed Validators. This is not a lofty prediction, but rather a strong recommendation for keeping Ethereum secure and decentralized. That’s why we describe Distributed Validators as “the staking end game.”