Obol Q4 2025 Ecosystem Report

We round up Obol’s highlight moments from the final quarter of 2025 and what comes next, including our move to a multi-client architecture with Nethermind, the Obol Stack’s push to keep Ethereum decentralized, and the first sovereign-backed entity adopting Distributed Validators.

Obol’s latest big milestones have established a robust foundation for advancing the staking end game to ensure Ethereum excels in 2026.

Obol Doubles Down on Ethereum’s Core Strength

2025 was our most accomplished year to date and our biggest wins from the final quarter played a key part in that. In Q4, Obol confirmed our commitment to Ethereum’s decentralization as we announced our plan to go multi-client and rolled out a series of new Obol Stack integrations.

Obol will move to a multi-client architecture with help from the esteemed Ethereum developer Nethermind. Pluto will be the second Distributed Validator client, offering full interoperability with Charon. Thanks to its client diversity, Ethereum has achieved 100% uptime since inception. Pluto will ensure that Distributed Validators maintain it at the middleware layer. It’s set to launch in 2026.

The Obol Stack, meanwhile, shipped new integrations that create a foundation for the Ethereum ecosystem with a focus on decentralization. Our team took the opportunity to update the Ethereum community on the Obol Stack and Pluto at Devconnect Argentina, the first Ethereum World’s Fair and one of the most memorable conferences in a minute. Devconnect week reminded us why Ethereum is special so it feels apt that our announcements signaled our support for decentralization.

Other standout moments from Q4 include the first case of a sovereign-backed entity adopting Distributed Validators and Pantera Capital publishing its Obol Thesis. Both events validate Obol’s mission, highlighting the industry’s move towards the staking end game. 2026 is the year this shift accelerates and our Q4 highlights make this clearer than ever.

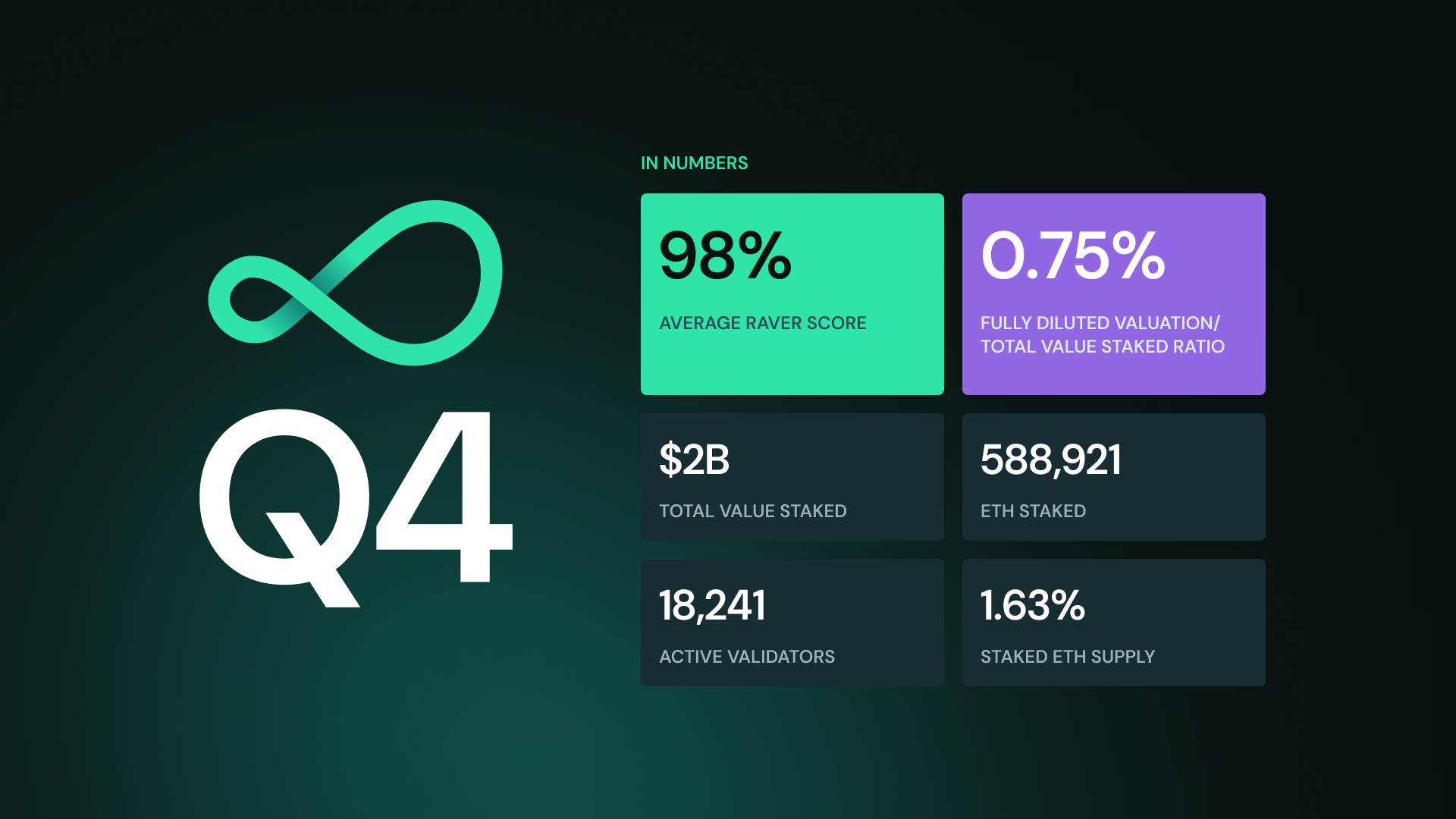

1. Q4 in Numbers | Obol Holds Strong Amid First Institutional Adoption Innings

Q4’s market action lacked the momentum many were hoping for following a strong summer led by Ethereum. Still, Obol held firm even as ETH experienced a months-long drawdown from Q3 highs.

The total value staked in Obol sits at $2B at writing, with almost 600,000 ETH deployed on Distributed Validators. This makes Obol one of the largest protocols on Ethereum (currently ranked 15th, per DeFi Llama TVL data). The total value staked represents roughly 1.63% of the supply of staked ETH today (with a target of 10% by the end of 2026).

Today, about 30% of the ETH supply is staked. In 2026, we expect this figure to climb due to rising institutional appetite for yield. Moreover, the proportion of the staked supply on DVs will rise. Obol saw its first wave of institutional adoption in tandem with ETH last year, the first innings of a decade-long trend.

Resources:

Obol Dashboard [Obol Dashboard]

2. New Obol Adoption | First Sovereign-Backed Entity Adopts Distributed Validators

Obol extended its momentum in Q4 as adoption accelerated into the tail end of the year. Together with Solstice Staking and Bitcoin Suisse, Liechtenstein Trust Integrity Network (LTIN) deployed stake on Obol Distributed Validators for the first time. LTIN is a sovereign-backed blockchain network, marking a first-of-its-kind deployment on our infrastructure. It is clear that the staking ecosystem is maturing and sophisticated entities are placing their trust in Obol to secure their operations.

In addition to LTIN, Blockdaemon and ParaFi Tech both committed to integrating Obol Distributed Validators in Lido’s Curated Module. Blockdaemon’s move came after upgrading to DVs for the first time in the summer, describing Obol as a “significant advancement” on legacy staking infrastructure. We look forward to helping more Curated Module operators upgrade their technology in 2026.

One of DeFi’s biggest success stories of recent years, Pendle integrated stOBOL in Q4. We elaborate on this integration below. Also, the privacy-focused L2 project Aztec integrated the Obol Stack for its Ignition Chain and Optimum teamed up with us as part of a pledge to scale and decentralize Ethereum concurrently.

From sovereign-backed institutions to major node operators and Ethereum mainstays, Obol continues to attract attention from the most established and respected entities in the space.

Resources:

Blockdaemon Doubles Down on Obol Distributed Validators [Obol Blog]

Obol and Optimum Unite to Supercharge Ethereum Scaling [Obol Blog]

Obol is now live on Pendle [@Obol_Collective]

Ignition Chain is live via Aztec [@Obol_Collective]

Liechtenstein’s Sovereign Blockchain Network Is Now Staking on Obol DVs [Obol Blog]

3. Product Updates | Nethermind to Bring Middleware Client Diversity to Ethereum

Ethereum introduced PeerDAS with the Fusaka hard fork in December and Charon maintained 100% uptime through the upgrade with zero interruptions. But Fusaka was only one of several milestones for Charon in Q4. Since October, our middleware client has shipped multiple improvements. These include introducing chain split protection, opt-outs for beacon node requests to boost performance, a charon deposit sign command to enable deposit data updates, and unblinded block tracking.

We also launched the DV Spec, the first multi-client interop specification for DVs. The DV Spec enables the end game staking configuration because it allows client diversity at the middleware layer. Following its launch, Obol and Nethermind jointly announced the new DV client Pluto at Staking Summit. Pluto will harden Obol and make Ethereum more secure.

The Obol Stack also had a lead role in our Q4. At Devconnect Argentina, our co-founder and CTO Oisín Kyne explained how the Obol Stack will let anyone run local applications on Ethereum in a permissionless, trustless manner. Aztec announced IgnitionChain, a privacy-based L2 that will leverage the Obol Stack, onstage at the same event. Since then, the Obol Stack has added Ethereum Helm Charts with help from ethPandaOps and the DV Pod. Ethereum Helm Charts equip developers with advanced tooling and telemetry for a robust L1 node. The DV Pod acts as an autopilot for the staking end game, offering a seamless way to deploy DVs with the Obol Stack.

Our key product updates from Q4 have established a strong bedrock for us to build on in 2026. Look out for more news on Pluto and the Obol Stack coming soon.

Resources:

Charon v1.7.0 goes live [@Obol_Collective]

Introducing the DV Spec [@Obol_Collective]

Announcing Pluto: a Distributed Validator Client by Nethermind [Obol Blog]

The Obol Stack integrates Ethereum Helm Charts [@Obol_Collective]

The Obol Stack integrates the DV Pod [@Obol_Collective]

Charon v1.8.0 goes live [@Obol_Collective]

4. The OBOL Token | Preparing for OBOL’s Next Evolution in 2026

As Obol continued building in Q4, the OBOL token also unlocked several achievements. Throughout the last quarter, our team has been conducting research into how the OBOL token should evolve in 2026. Our work includes looking into the token’s utility and economics and buyback and liquidity supply approaches akin to those proposed by Lido. As one of Ethereum’s most crucial pieces of infrastructure, Obol is on course for significant growth in 2026 and OBOL will sit at the center of our ecosystem. With $2B staked, Obol is already among the most used and trusted protocols on Ethereum (currently ranked 15th in total value staked or locked, per DeFi Llama data). We expect this figure to climb throughout 2026.

OBOL also secured a listing on Kraken, one of the world’s largest exchanges, in November. Obol is on a mission to power and secure the Ethereum economy and this update is a signal that the industry at large sees this.

Pendle also added support for stOBOL in collaboration with DAMM Capital. Pendle is one of the breakout DeFi applications of recent years, focused on “liberating yield” by making it tradable onchain. This integration lets users manage their exposure to stOBOL’s staking returns by going long on the yield or locking it in for a fixed duration. With Pendle’s tradable yield, Obol gets more utility and composability.

Resources:

OBOL is live on Pendle [@Obol_Collective]

Obol is live on Kraken [@Obol_Collective]

OBOL is available for trading! [Kraken Blog]

5. Community Snapshot | Building Connections at Devconnect Argentina

Lido launched its new Community Staking Module at the start of the quarter with day one support from Obol. CSM v2 introduces Identified Community Stakers, and with squad staking, individuals can start staking with just 0.3 ETH. Identified Community Stakers also receive a boosted reward share of 6%. Squad staking in CSM v2 is the easiest path to mainnet. This may explain why around 70% of ICS applicants came in via the Obol Techne Credential initiative. CSM v2 users understand that Obol is the optimal way to get started on their staking journey.

Our team forged closer ties with the Obol and broader Ethereum community last quarter, not least at Devconnect Argentina. We had a strong presence in Buenos Aires with booths at Staking Summit and Devconnect proper, with nine presentations across the main event and side events. We used the week to connect with our key supporters and preview our big focuses for 2026: helping the ecosystem upgrade to the Ethereum staking end game and expanding the Ethereum economy with the Obol Stack. Thank you to all of our partners and community members for joining us.

As we recently shared on the Obol forum, another action for us in 2026 will be improving our transparency and data verifiability. As a starting point, Obol now appears on DeFi Llama with historical TVL data and more data to appear soon. This is just the beginning of our work into providing a view into Obol’s key figures. Obol is accelerating with Ethereum in 2026 and we want our supporters to have full clarity into our progress.

Resources:

Squad Staking in CSM v2: More Nodes, Less Risk, Higher Yield [Obol Blog]

Devconnect Argentina: Five Key Takeaways [@Obol_Collective]

Community Update: Enhancing Data Transparency and the Path Forward [Obol Forum]

6. In the News | Pantera Signals Belief in the Ethereum Staking End Game

Pantera Capital published a piece outlining its Obol thesis in October. In it, the leading investment firm argued that Ethereum needs to embrace the staking end game with Distributed Validators. The piece also described Obol Distributed Validators as “a new standard for the future of staking.” This is essential reading for anyone looking to get ahead of the next meta in Ethereum staking.

We also published a new research piece covering the state of Ethereum in South Korea in partnership with DSRV last quarter. The report explores how the South Korean scene is thriving despite years of regulatory setbacks with predictions into how the region could embrace Ethereum in the future. This is only our first foray into South Korea with more to come in 2026.

Our team also appeared on the airwaves over Devconnect Week. Highlights included Oisín’s sit-in with Staking Summit, where he discussed the future of the staking ecosystem and why Ethereum needs the Obol Stack. Obol’s VP of Ecosystem Anthony Bertolino also joined P2P for a discussion packed with hot takes on staking and the growing indispensability of Distributed Validators.

Resources:

Our Obol Thesis [Pantera Capital Blog]

Obol and DSRV unpack the state of Ethereum in South Korea [@Obol_Collective]

Staking Summit Buenos Aires interview with Oisín Kyne [Staking Rewards]

What does the future of Ethereum staking actually look like? [@P2Pvalidator]

Wrapping Up

Obol had a massive 2025 and that momentum continued into the home straight of the year. But the most important steps we took in Q4 have set us up for what follows in 2026 and beyond. Institutional adoption drove Ethereum’s resurgence in 2025. Now, we are about to see many more major capital allocators turn their attention to Distributed Validator technology due to its superiority over legacy validator technology.

Ethereum is thriving because it offers unparalleled security and decentralization benefits. From Pluto to the Obol Stack, Obol signaled its commitment to preserving these crucial properties last quarter. Ethereum is the world’s most secure and decentralized blockchain and base layer for the global onchain economy. Obol is the next-generation infrastructure that will power and secure it.